Debt Snowball Get Rid of Your Unpaid Credit Card Debt

A debt snowball is one of the best solutions to eliminate your credit card debt. You have seen the image. Start at the top of a hill with a small snowball and let it roll down.

As the ball goes further down the hill, it begins to pick up more snow and speed. And on it goes building momentum, getting bigger and faster, bigger and faster, bigger and faster until it reaches its destination -- Pow! All done.

This snowball debt reduction method causes the plastic money to be paid off faster and faster. Here is how it works:

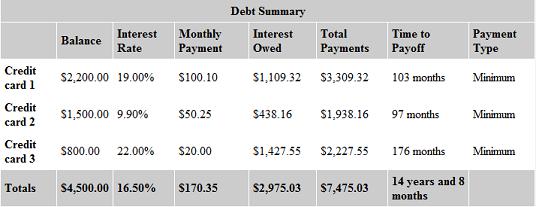

Joshua has three pieces of plastic, paying the minimum on each:

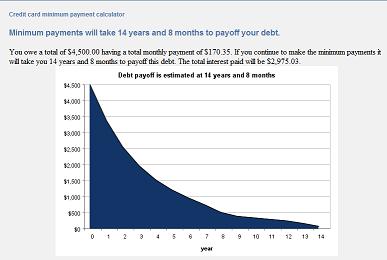

15 Years of Payments

At this current rate, a payment calculator at www.bankrate.com states it will take 14 years and eight months with a total of $2975 of interest.

Payments for 15 years? Now that is a ugly. Joshua can do better.

What if he kept paying the minimum payments, but when the lowest balance is paid he applied that $20.00 he was not used to having anyways to the next card with the new lowest balance (MasterCard)? This is how the debt snowball works.

Now the payments are accelerating, the debt snowball payment is getting bigger, and eventual complete payoff is approaching faster. But wait, there's more! Looking at the table above, once the MasterCard is paid off, apply the $70.00 ($50.00 plus $20.00) is then added to the Visa's $100 for a total of $170 working to create an even bigger and faster payment snowball racing down the hill to destination payoff.

Down to Less than 3 Years of Payments

Using a debt snowball calculator found at www.whatsthecost.com/snowball.aspx, it will take just 32 months and $997 of interest. A savings of $924.00 and almost 12 years of payments! Much better.

Paying down the small balance first gives a psychological boost when it gets paid off, and the payment for that card is then added to the balance of the next, building the debt snowball a bit quicker.

A Step Further

Are you ready to go just one step further? How about scrounging around your expenses and come up with an extra $10.00 per month to get rid of your payments?. This would make the American Express $30.00 per month and then that would move on to the next one and next as just explained. What does this simple $10.00 due to the overall payoff?

Adding $10.00 to the monthly pay off of the first one in our example and then letting it snowball yields a payoff of one month earlier with total interest savings of $52.00. An extra $15.00 applied monthly almost doubles that.

Now, these figures are for Joshua who owes $4500, which is far lower than the national average. You can see the small extra payments applied to the principle yields tremendous results at the end. Knowing the amount you owe to your creditors, what could this snowball debt reduction plan do for you?

Consolidation loan? Say no to the extra fees and interest. Just get disciplined and do it yourself, pocketing the savings.

If you still feel overwhelmed, maybe coaching is right for you. See for yourself. In the meantime, some of the best solutions to credit card debt is to cut your expenses, get on a written budget, and write your success story below!

This series continues with a warning about credit card consolidation loans.

Back from Debt Snowball to Best Credit Card Debt Help.

Back to Household-Budget-Made-Easy.com.