Reducing Credit Card Debt Credit Card Debt Solutions

Reducing credit card debt is easy by creating a personal budget.

You are here looking for quick credit card debt solutions. Chances are it has taken years to get into the credit card debt lifestyle; so it should not be surprising that it could conceivably take years to get out.

All of those commercials saying you can eliminate half of what you owe overnight is ridiculous and a scam. Yes, your card companies are willing to negotiate with you, but at a cost. More on that later.

Do not be in the mind set of being able to immediately eliminate it all. Doing so will get you frustrated and wanting to quit. Same with exercising and diets. If you start small, set a goal and work at it diligently, you will soon notice that reducing credit card debt is addicting. You will see that proverbial light at the end of the tunnel.

How Long Until We Get There?

As I have worked with many individuals on their own budgets, the average time to pay it all off, including the mortgage has been about eight to eleven years. Yes, that is right, including the mortgage!

For even more encouragement, the average time for just the plastic (everything except the mortgage) is about four years!

Doubling Your Payments

It is interesting to note that during recessions, people generally use their disposable income in reducing credit card debt and sock money into a rainy day fund. With interest rates around 20%, high late fees, etc., just paying the minimum balance due each month will keep it around until you are just about dead, and doubling in payments what you purchased in the first place.

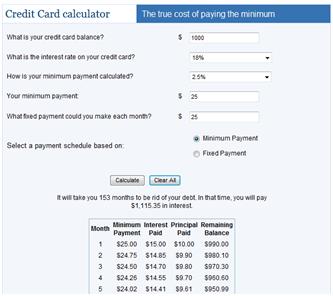

Using a payment calculator found at bankrate.com, here is the result of that gotta have TV payments:

Just think about that. If you purchase a $1000 television on borrowed money and ONLY pay the minimum balance due, that same TV will have actually cost over $2000! Thirteen years of payments and $1153 just in interest? For many televisions and like equipment, that TV will be at an e-waste site before you pay it off. It is just not worth it! Dave Ramsey calls this a stupid tax. I agree.

Becoming Debt Free

Here is my advice: Stop it! Stop using that that piece of plastic if you do not have the money already in the bank. How do you ensure that happens? Create a personal budget and become completely financially free. Woohoo!

Becoming debt free means exactly that: Debt Free. Owing not a single red cent to any person gives you unparalleled freedom to do what you want to do with your money. I use the words you and your because it catches your attention as it relates to money. In reality, however, it is God's money and we need to discern what he wants us to do with what is given to us.

If thy little pieces of plastic offend thee, cut 'em up. Hide them, burn them, mulch them, shred them. Do whatever it takes to stop being dependent on them.

I have a little something that might give you a psychological edge. It is a Get Out of Debt Emergency Kit to help you get out of this habit. Yes, of course it is a little gimmick. BUT, an effective one. Download it free of charge, add the required envelope and let us know below how effective it is for you.

Reduce the Expenses

To begin reducing credit card debt, you must reduce expenses.

Living on a budget is a great way to do this; it is the most effective way to sustain your reduction and become financially free. Try it and experience how it really works!

This series continues with an explanation of the debt snowball method.

Back from Reducing Credit Card Debt to Best Credit Card Debt Help.

Back to Household-Budget-Made-Easy.com.